Best Cities for Renters as Minimum Wages Rise and Cost of Housing Falls

Getty Images (3)

Renters across the U.S. have something to cheer about: Rents declined in November, making it a bit more affordable for many—especially those earning minimum wage.

Across the 50 largest metros, the median rent was $1,703—down $17 from last month and $57 from its peak in August 2022, according to a new Realtor.com® report.

The median rent for 0-2 bedroom properties dropped by $19 year over year, or 1.1%, marking a hopeful trend in rental affordability.

“As the rental market has cooled, rents have fallen for 16 consecutive months nationwide,” says Realtor.com economist Jiayi Xu in her analysis.

But how much relief will this drop bring to renters, especially in cities where affordability remains challenging? It might be substantial, considering that the minimum wage is set to rise in 2025.

Nationwide rent declines

Renters saved last month across the board, with smaller properties seeing the largest percentage drop in rents.

The median rent for studio apartments fell by 1.6% year over year, to $1,423, a $67 decrease from its peak in October 2022.

One-bedroom units saw median rents drop 1.2%, to $1,585, $73 below their August 2022 peak. And rents in two-bedroom units decreased by 1.1%, to $1,886, $75 less than their high in August 2022.

Despite these declines, Xu’s analysis reveals that rents have risen significantly since before the COVID-19 pandemic. Still, the increase isn’t as dramatic when compared with other economic changes over the same time.

For example, while the typical rent in November 2024 was $261 (18.1%) higher than in 2019, overall consumer prices jumped 22.7% in the same five years.

Taking a broader view of housing costs, Xu notes that the rise in rents “pales in comparison to the 49.7% increase in median price per square foot of for-sale home listings in the five years ending November 2024.”

Starting Jan. 1, 2025, minimum-wage increases in 23 of the top 50 metros are expected to bring some much-needed relief.

Minimum-wage workers struggle with affordability

Even with falling rents, minimum-wage earners face an uphill battle when it comes to comfortably affording housing.

The November rental report found that minimum-wage renters still have to clock significant hours in cities with the largest rent declines to afford a typical 0-2 bedroom rental.

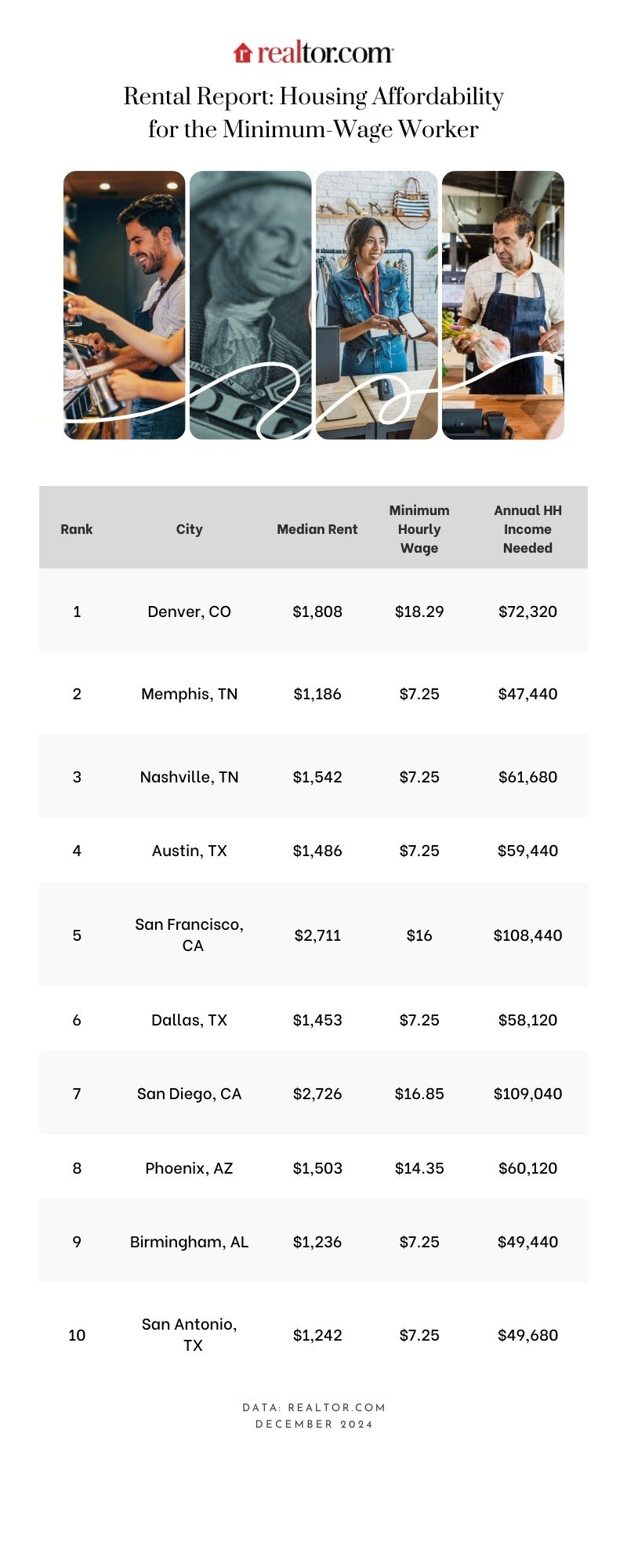

To come up with its findings, the Realtor.com data team analyzed how many hours someone earning minimum wage needed to work to afford a typical 0-2 bedroom rental in November. Using the 30% rule of thumb for housing affordability, the team calculated the annual income required and determined the weekly hours necessary. The analysis assumed two renters splitting the rent equally.

In 8 of the 10 markets analyzed, two minimum-wage workers splitting the rent would still need to work more than 40 hours per week to keep housing costs within 30% of their budget—especially in areas where the minimum wage is stuck at the federal rate of $7.25 per hour.

The best and worst cities for minimum-wage workers

Nashville, TN, and Austin, TX, lead the list in the highest number of hours minimum-wage earners need to clock in to afford the typical rent. Paying rent in these cities takes two minimum-wage workers not only splitting the rent—but also working an untenable 82 and 79 hours per week, respectively, to make rent each month.

“Affordability remains a significant challenge in rental markets, particularly for low-income groups,” Xu notes.

In cities such as Denver and Phoenix, however, two minimum-wage earners with fewer than 40 hours of work per week can afford a typical 0-2 bedroom.

In Minneapolis and Seattle, they need to work approximately 37 hours per week to cover the cost of a similar rental unit.

“The significant disparity in the working hours required to afford rent across Seattle, Nashville, and Austin is primarily due to differences in minimum-wage laws,” says Xu.

“For example, Seattle has its own minimum-wage law, setting the minimum wage at $19.97 per hour. In contrast, Tennessee does not have a state minimum-wage law, so the federal minimum wage of $7.25 per hour applies.”

Relief on the horizon for some cities in 2025

If rents remain consistent with November 2024 levels, minimum-wage earners in eight markets will see at least a two-hour reduction in the weekly work hours needed to afford rent.

“Leading this relief are St. Louis, MO, and Kansas City, MO,” says Xu.

In these two Midwestern locales, minimum-wage workers will save approximately four hours of work per week once the minimum rises to afford rent.

For cities such as Minneapolis and Seattle, where higher minimum wages already allow renters to cover costs within a 37-hour workweek, the upcoming increases may further reduce the monthly nut.

“With scheduled minimum-wage increases in more markets throughout the year and a projected 0.1% year-over-year decline in median asking rents for 2025, these changes could offer more relief to minimum-wage earners,” says Xu.

What rent declines mean for the future

The sustained rent decline is a win for renters and a positive indicator of broader economic trends.

“The relative steadiness in rents should translate into slower shelter inflation in the months ahead, alleviating one of the biggest recent drivers of a rising price level,” says Xu.

This is especially critical as housing costs make up a significant portion of the consumer price index.

Yet, challenges remain. While lower rents combined with rising minimum wages provide relief in some areas, the pace of affordability improvements varies significantly by region.

In markets where the federal minimum wage of $7.25 per hour persists, many renters will likely continue to struggle.

“While the median asking rent in Seattle is nearly 30% higher than rents in Nashville, the hourly earnings of a minimum-wage worker in Seattle are 175% higher than those of a minimum-wage worker in Nashville,” says Xu. “This substantial wage difference enables Seattle workers to afford housing with fewer hours of work, despite the higher rents.

“Even in markets with higher state or local minimum-wage laws, such as San Francisco, CA, and San Diego, CA, working hours beyond a full 40-hour workweek are required.”

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

1637 Racetrack Rd # 100, Johns, FL, 32259, United States