Boston Surprisingly Has an Abundance of Starter Homes Under $550K—Along With These Markets

Getty Images (3)

If you’re a first-time homebuyer looking to start your search in the new year, you might be surprised to learn that the Boston metro area is one you want to watch.

While the city’s median list price of $949,000 ($879 per square foot) might scare off any but the ultrahigh net worth purchasers, Boston-Cambridge-Newton, MA-NH, actually has a higher than average amount of starter homes, according to a new report from the National Association of Realtors® Research Group.

About 41% of Boston metro area owners are sitting on homes valued below $550,000, the report notes. The national average is 38.9%.

Starter homes are typically priced at 85% of the median-priced home in the area, and are critical for first-time buyers. Without these discounted homes, first-time buyers would likely be unable to buy and move elsewhere.

Areas with more starter-home inventory provide greater accessibility for younger or lower-income buyers, driving demand and creating a more affordable housing market.

“People buying under $550,000 will include first-time homebuyers, relocators and downsizers, investors, and Boston’s working class/immigrants,” says agent Bianca D’Alessio with The Masters Division at Nest Seekers International.

Still, Boston? Good for first-timers? Really? What about all those owners sitting on the sidelines because they are “locked into” COVID-19 pandemic rates, some of which dipped below 3%?

Boston, and the other nine cities on this list, have a lower-than-average amount of “locked-in” owners. The NAR says that when rates stabilize in the new year, these people will be more likely to cash in their gains, because they also saw above-average home appreciation from Q3 2019 to Q3 2024 (the national average is 56.2%).

But don’t buy those season Celtics tickets just yet.

“Due to the low inventory (lack of available land) in Massachusetts and the high desire to live here due to our top-rated medical and education fields, we have been in an extremely competitive market,” says D’Alessio. The starter home “is a specifically competitive price range to consider purchasing in.”

And of course, at that price range, there’s no guarantee of the condition of the homes or if they’re located in your ideal neighborhood. But a deal is a deal.

What went into choosing the cities? An evaluation of 10 criteria, including mortgage rates, job growth, the share of millennial renters in town who can afford to buy, the share of out-of-staters purchasing a home, and home price growth.

And all of the cities have a higher share of inventory of starter homes than the national level (38.9%).

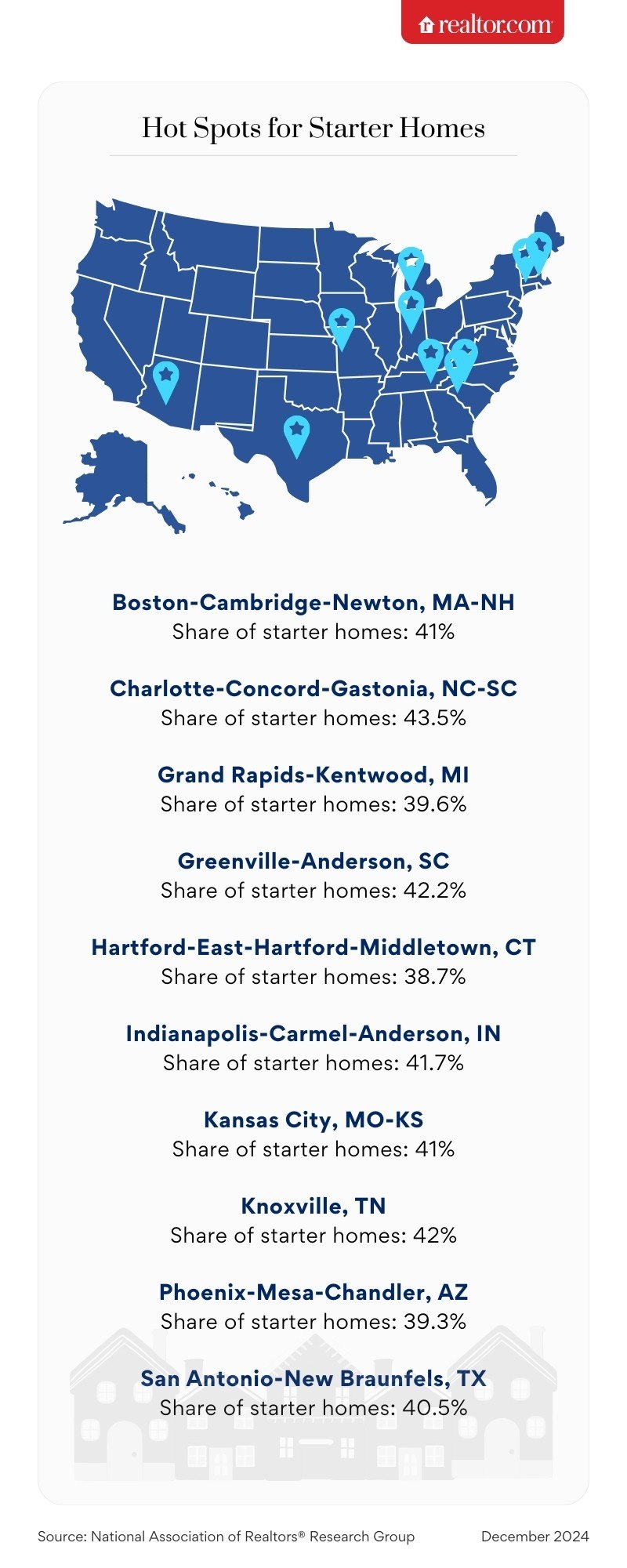

Add up the criteria, and these are the metros poised to have a robust housing market in the new year, listed in alphabetical order.

Boston-Cambridge-Newton, MA-NH

Share of starter homes: 41%

Median list price: $949,000

This famous college town’s housing market is expected to see significant benefits from stabilizing mortgage rates, says the NAR report.

With fewer homeowners locked into those low-low pandemic rates, the impact of the lock-in effect may lessen in the coming year as rates stabilize near 6%.

This should encourage homeowners sitting on the sidelines to sell, easing inventory constraints in this supply-tight market, and making Boston an unexpectedly hot area for first-time buyers.

Keep in mind that homes priced this way are likely not turn-key nor in your ideal neighborhood. There are, however, plenty of condos in this price range in more center areas.

Realtor.com

Charlotte-Concord-Gastonia, NC-SC

Share of starter homes: 43.5%

Median list price: $425,000

“With an impressive 10% job growth over the last five years and strong migration gains, Charlotte’s economy and housing market are poised for continued growth,” says the report.

More than 11% of the households in this metro are set to reach the age of 35 to 40 within the next five years, ensuring sustained demand for housing. (The average home buyer is 38 years old.)

A nice 43% of homes fall within the starter home category (priced less than $324,000), which makes the city appealing to first-time buyers and young families.

Grand Rapids-Kentwood, MI

Share of starter homes: 39.6%

Median list price: $319,900

With 36% of millennial renters in the area able to afford homeownership and 12% of households entering the prime homebuying age within the next five years, there will be plenty of buyers looking to purchase in this area.

“Grand Rapids offers a unique combination of affordability and promising long-term prospects,” says the report.

Price growth is a healthy 64.4%, compared with the national average of 56.2%. Add in a very reasonable median home list price, and Grand Rapids could be an ideal place to start your home journey.

Greenville-Anderson, SC

Share of starter homes: 42.2%

Median list price: $269,900

This area particularly benefits from a strong net migration rate (1.7% compared with 0.5% nationally) and affordability.

The metro’s average mortgage rate of 6.9% in 2023 is below the national average, providing additional relief for buyers.

“Greenville stands out as the area that checks off the most criteria on NAR’s top 10 list,” the report notes.

With 42% of homes categorized as starter and 43% of movers purchasing homes, not to mention a median list price that’s half the average, Greenville should be a happening market in 2025.

Hartford-East-Hartford-Middletown, CT

Share of starter homes: 38.7%

Median list price: $249,900

“Hartford offers a favorable financing environment, with an average mortgage rate of 6.5% in 2023, one of the lowest among the top markets, enhancing affordability for buyers,” says the report.

Additionally, the capital city holds the highest proportion of homeowners surpassing the area’s average tenure of 17 years, indicating a potential increase in local inventory.

Add in its halfway mark between New York City and Boston, the plenty of bucolic towns lining the Long Island Sound, and lots of public transport, and this is an ideal state to start a family.

Realtor.com

Indianapolis-Carmel-Anderson, IN

Share of starter homes: 41.7%

Median list price: $260,000

Nearly 42% of the housing stock is priced below $236,000, making the market especially appealing to first-time buyers and young families.

“Indianapolis earned a spot on the list due to its strong job growth (9.3% vs. 5% nationally) and housing affordability, which continue to attract new residents and foster a stable demand for housing,” according to the report.

With fewer locked-in homeowners than at the national level (75.5% vs. 76.1% nationally), this area is likely to see more available inventory as mortgage rates stabilize around 6% next year.

Kansas City, MO-KS

Share of starter homes: 41%

Median list price: $256,900

“This area is also one of the most affordable markets for millennial renters, with 1 in 3 of them able to afford homeownership,” says the report.

This affordability, combined with its competitive financing environments, makes Kansas City a key player among top-performing housing markets in the coming year.

Additionally, the metro is one of the few areas with both a lower-than-average mortgage rate and a smaller share of locked-in homeowners (75.5% vs. 76.1% nationally), creating favorable conditions for first-time homebuyers in 2025.

Knoxville, TN

Share of starter homes: 42%

Median list price: $429,900

Knoxville is attractive to people looking for a long-term commitment to an area, as nearly 50% of new residents chose to purchase a home, says the report.

Homeowners in the area have also seen their investment balloon, with home prices now nearly double their pre-pandemic levels, hinting that owners will want to cash in next year.

Strong migration (1.6% vs. 0.5% nationally), high homeownership among movers, and significant wealth gains make Knoxville a market to watch.

Realtor.com

Phoenix-Mesa-Chandler, AZ

Share of starter homes: 39.3%

Median list price: $499,000

Phoenix has a slightly higher percentage of locked-in owners (79.8%) than the national average, so inventory might be lower, but the city has become a key destination for residents fleeing high-priced California, driven by its lower cost of living and relative housing affordability.

That combined with a strong jobs market makes Phoenix a contender in 2025.

San Antonio-New Braunfels, TX

Share of starter homes: 40.5%

Median list price: $293,000

“Borrowers in San Antonio were able to secure mortgage rates well below the national average in 2023, at 6.4%,” says the report. “This suggests that buyers in the area benefit from a combination of local market dynamics that lead lenders to assess lower risk in this area.”

Despite the high locked-in rates (81.1% vs. 76.1% nationally), NAR believes that the metro is one to watch thanks to a strong jobs market (10.7%) that is more than double the national average and strong migration to the area from out of state.

It also contains a high amount of millennial renters (30.7%) who will likely want to buy once rates dip next year.

Add in a low median list price, and San Antonio is a city that first-time homebuyers will likely find attractive.

Realtor.com

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

1637 Racetrack Rd # 100, Johns, FL, 32259, United States