Fed Cuts Interest Rate by a Quarter Point, but Don’t Expect Big Declines for Mortgages Yet

Olivier Douliery/AFP/Getty Images

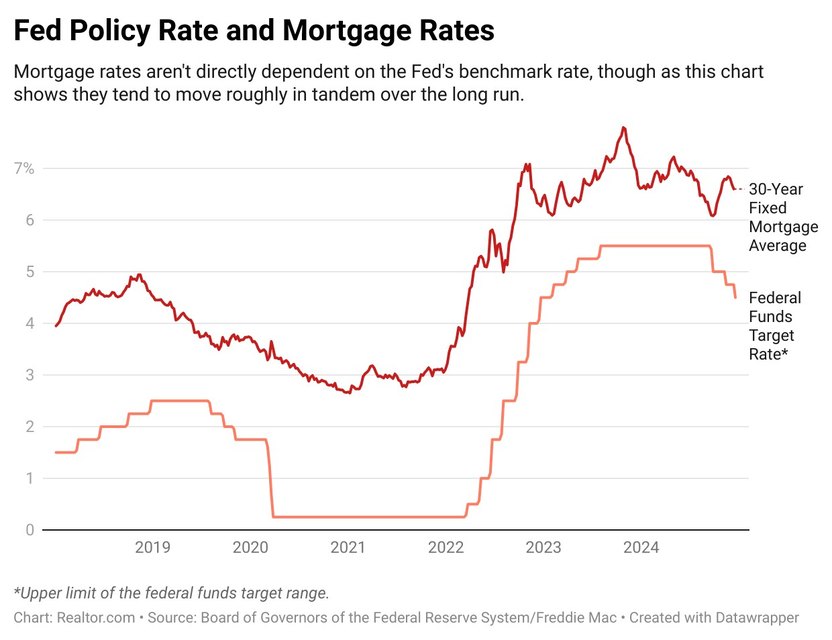

The Fed has delivered another interest rate cut, but unfortunately for homebuyers, it won’t mean imminent relief for mortgage rates.

As expected, the Federal Reserve cut its overnight policy rate by 0.25 percentage points on Wednesday, bringing the rate down to a new range of 4.25% to 4.5%. The new range represents a full percentage point reduction from the recent peak range of 5.25% to 5.5%, where rates held steady for a year before the recent cutting cycle began in September.

Because the Fed’s latest cut was widely expected by investors, it is already largely priced in to the long-term bond markets that ultimately determine interest rates on home mortgages.

That means the latest rate decision itself is unlikely to move mortgage rates dramatically. For the week ending Dec. 12, rates for 30-year fixed mortgages averaged 6.6% after three straight weeks of declines, according to Freddie Mac.

In a troubling sign for mortgage borrowers, forecasts released by Fed policymakers alongside the rate decision took a hawkish turn, projecting only two further quarter-point cuts through 2025, down from four in the projection issued in September.

As well, the vote to cut rates this time around was not unanimous, signaling that some policymakers are concerned that the current pace of loosening is too fast. Taken together, those signals could work to drive mortgage rates higher in the coming days and weeks, though any uptick is unlikely to be dramatic.

“I don’t expect to see a huge reaction from mortgage rates to this news because the market had largely already priced these expectations in,” says Realtor.com® Chief Economist Danielle Hale. “In short, the Fed’s current stance mirrors where the market had already moved.”

The Realtor.com economic research team projects that mortgage rates will continue to average above 6% through 2025, dropping slowly to around 6.2% by the end of the year.

Chair Powell warns Fed will be ‘more cautious’ about future cuts

The Fed adjusts its policy rate in response to its dual mandate to sustain maximum employment and keep inflation at a target of 2%. The central bank raises interest rates to fight inflation—and lowers them to juice the economy and boost the job market.

In remarks at a postmeeting press conference on Wednesday, Fed Chair Jerome Powell said that policymakers are now equally attuned to risks from both sides of the mandate, and would proceed cautiously with future rate cuts to avoid reigniting rapid inflation.

“With today’s action, we have lowered our policy rate by a full percentage point from its peak, and our policy stance is now significantly less restrictive,” he said. “We can therefore be more cautious as we consider further adjustments to our policy rate.”

Powell expressed confidence in the strength of the economy, citing labor market conditions that remain solid, resilient consumer spending, and steady growth in gross domestic product.

But he acknowledged weakness in the housing market, which has languished under the impact of stubbornly high mortgage rates and home prices in recent years.

“Housing activity is very low, and that’s probably significantly because of our policy,” said Powell.

Data due out later this week is expected to show that home sales approached a 30-year low across 2024, with many buyers pushed to the sidelines by affordability concerns.

Still, the housing market has seen some buyer-friendly trends in recent months, including a rising supply of homes for sale and an increase in listings with price reductions.

“A solid economic backdrop in the year ahead is expected to underpin the 2025 housing market, ushering in a bump in home sales and modest deceleration in home prices,” says Hale.

“That doesn’t mean that the housing market is without challenges,” she adds. “Buying a home still takes a larger share of your paycheck today than in recent history, but income growth in 2025 is expected to start to reverse that trend, and if homebuilders ramp up production, as expected, we will start to close the gap on the housing shortage that has long been a thorn in the side of homebuyers, especially first-time homebuyers.”

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

1637 Racetrack Rd # 100, Johns, FL, 32259, United States