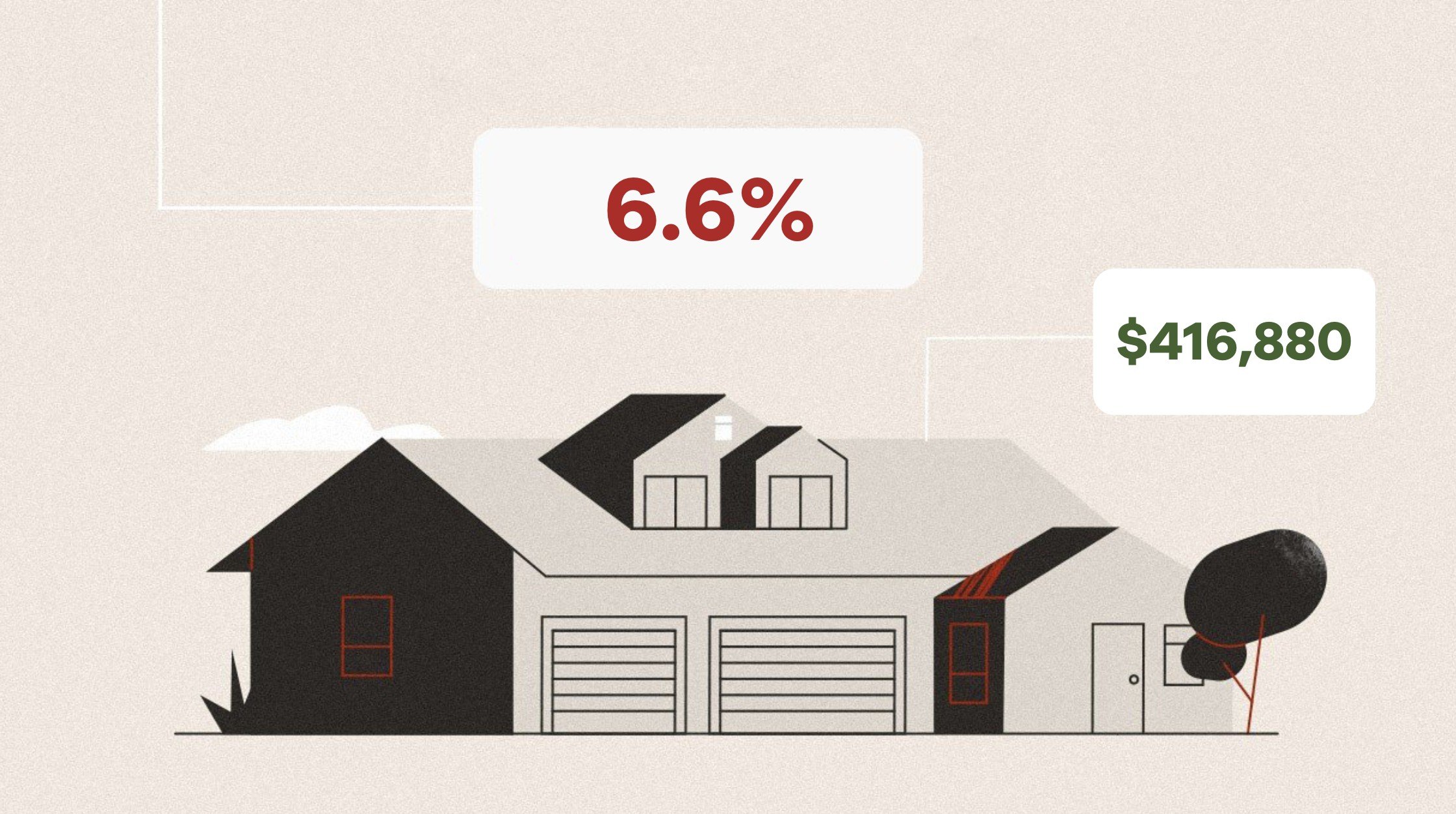

Mortgage Calculator: This Is How Much You Need To Buy a $416,880 Home With a 6.6% Rate

Realtor.com

Mortgage rates for a 30-year fixed loan fell to 6.6% this week, down from 6.69% last week.

The median listing price nudged up by 0.2% compared with last year. (Median home prices hit $416,880 in November.)

What impact do these changes have on your monthly mortgage payment?

Here’s the monthly cost of purchasing a typical home today, according to the Realtor.com® mortgage calculator.

Monthly mortgage payment today with a 20% down payment

The typical monthly payment on a median-priced $416,880 home at today’s 6.6% mortgage rate is roughly $2,129.95. (It is based on a 20% down payment and excludes tax and insurance.)

Conversely, a median-priced home at $416,880 financed at last week’s rate of 6.81% would have resulted in monthly payments of $2,176. That means, on average, buyers who closed last week will spend $46 less a month compared with those who close this week.

Yet, if you examine the peak mortgage rate of 7.79% in October 2023 and compare those payments with loan installments today, current homebuyers are much better off now.

In October 2023, buyers would have paid $2,398.49 monthly on a $416,880 home with 20% down. This means homebuyers today can save $268.54 a month, or $3,222.48 a year, compared with buying when rates peaked.

Monthly mortgage payment today with a 3.5% down payment

For most borrowers, FHA loans require a 3.5% down payment.

Assuming a 3.5% down payment and excluding tax and insurance, the typical payment at today’s 6.6% mortgage rate on a median-priced $416,880 home is roughly $2,569.26 monthly.

Last week, a median-priced home at a 6.81% mortgage rate would have cost homebuyers $2,625 per month—$55.74 less than what buyers would pay today.

Nonetheless, mortgage payments at today’s rates on a median-priced home are still a $323.92-per-month improvement over October 2023, when rates peaked at 7.79%.

Long-term savings

When you multiply these monthly savings by 30 years, they add up dramatically.

If you buy a $416,880 house at today’s 6.6% rate with a 20% down payment, you’ll pay a total of $766,782.97 over the life of a 30-year loan.

If you bought that same $416,880 home with 20% down in October 2023, when rates peaked at 7.79%, that loan would cost you $863,455.89. Total savings over 30 years: $96,672.92.

Now, let’s turn our attention to FHA loans.

If you put down 3.5% on a $416,880 house financed at 6.6% today, you’ll pay $924,931.96 over the life of the loan.

If you’d put down 3.5% on a $416,880 home in October 2023, when rates peaked at 7.79%, you’d pay $1,041,543.67. Total savings over 30 years: $116,611.71.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

1637 Racetrack Rd # 100, Johns, FL, 32259, United States