Mortgage Rates Are Projected To Stay Higher for Longer Than Expected in 2025, Fannie Mae Says

Andrew Harnik/Getty Images; Realtor.com

Mortgage rates will likely remain higher this year than previously expected, due to persistent inflation and lingering uncertainty about President Donald Trump‘s trade policy, according to Fannie Mae.

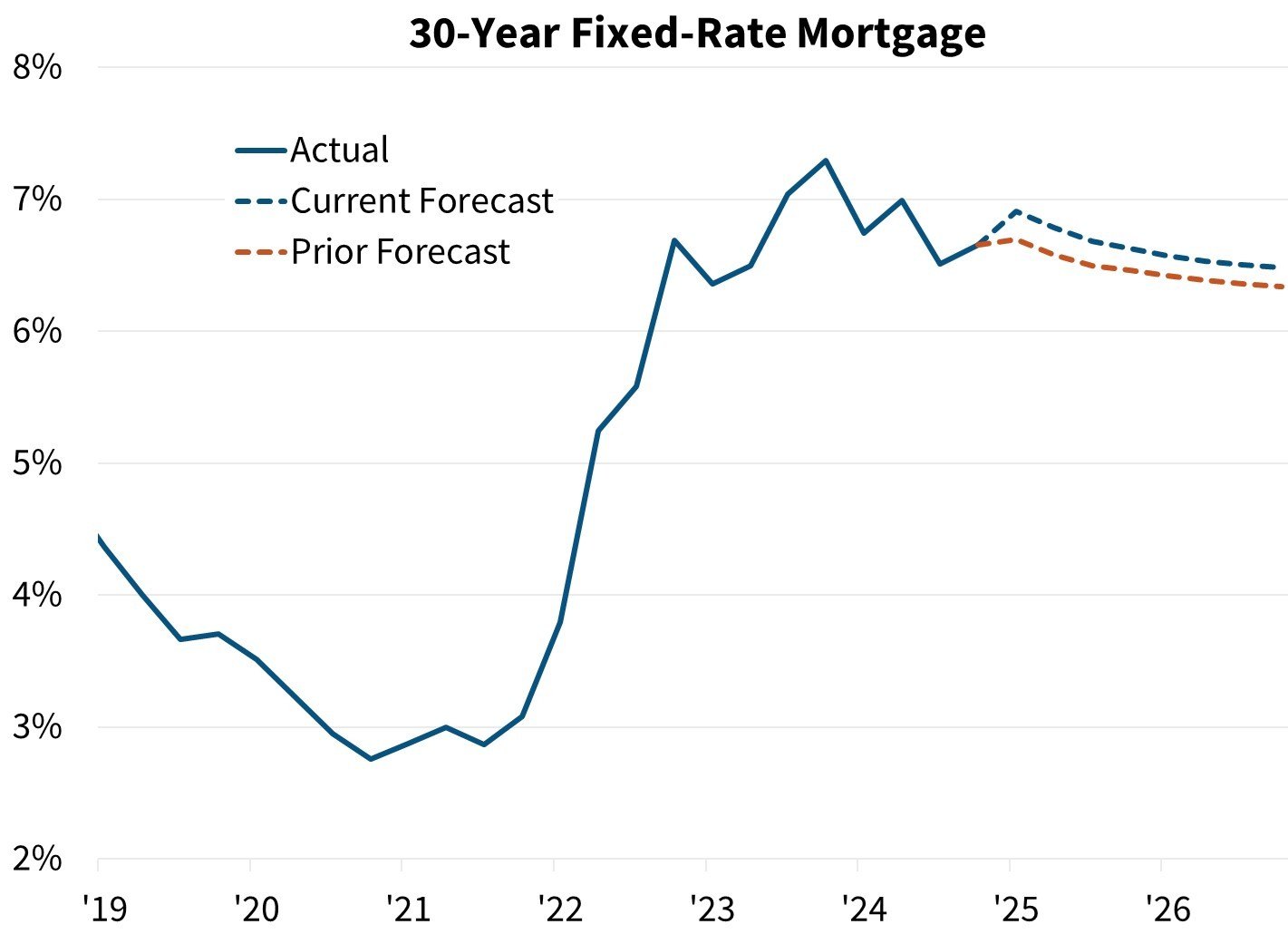

In a revised projection last week, Fannie Mae says it expects the 30-year fixed-rate mortgage to average 6.8% across 2025, and end the year at 6.6%.

That’s the second upward revision in a row for Fannie Mae, which in December projected rates to average 6.2% by the end of 2025, and bumped that up to 6.5% in January.

So far this year, rates have remained stubbornly close to 7%. Mortgage rates averaged 6.85% last week, according to Freddie Mac, and have remained above 6.8% since mid-December.

A number of factors are to blame, including hotter inflation data and stronger economic growth so far this year than most economists had expected.

Uncertainty also surrounds the implementation of Trump’s agenda on tariffs, which could influence homebuilding costs and long-term borrowing rates.

Higher tariffs could spur goods inflation and drive interest rates higher, and Trump has sown uncertainty by threatening, then suspending, massive tariffs on Canada and Mexico.

“Economic growth was strong to start the year as fourth-quarter personal consumption data came in above our expectations,” says Kim Betancourt, Fannie Mae’s vice president of multifamily economic and strategic research.

“However, ongoing uncertainty around trade policy adds risk to our GDP and inflation outlooks, which may have implications for mortgage rates, although the direction—up or down—would depend on a number of factors,” she adds.

Fannie Mae’s Economic and Strategic Research Group also revised its projection for existing-home sales slightly upward for 2025, due to a stronger-than-expected December sales pace and resilient purchase applications data.

However, the level of existing sales is still expected to be 22% below the pace seen in 2019, following two consecutive years of nearly 30-year lows for home sales in 2023 and 2024.

The path of mortgage rates will also have a significant effect on the pace of home sales for the year.

“Higher mortgage rates would exacerbate the existing ‘lock-in effect’ and worsen affordability, which may then weigh on home sales and mortgage originations activity,” says Betancourt. “Of course, if mortgage rates move lower, we’d likely see an improvement in affordability and a corresponding pickup in housing activity.”

In December, the Realtor.com® economic research team initially forecasted mortgage rates would gradually ease through 2025, and average around 6.2% by the end of the year.

Since then, the Federal Reserve has paused its cuts to the short-term policy rate, and the outlook for any further cuts this year has dimmed significantly, putting upward pressure on long-term mortgage rates.

“Since we issued our mortgage rate forecast as part of the housing and economic forecast, mortgage rates have trended higher than we expected,” says Realtor.com Chief Economist Danielle Hale.

“If we were issuing an updated forecast today, the mortgage rate projection would likely be revised higher,” she adds. “An above-average amount of policy uncertainty makes it hard to put a fine point on any forecasts, but I think a year-end rate closer to 6.5% is now more likely.”

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

1637 Racetrack Rd # 100, Johns, FL, 32259, United States