Mortgage Rates Just Hit Their Highest Point This Year: Is It a Blip or a Housing Death Blow?

Photo-Illustration by Realtor.com; Source: Getty Images

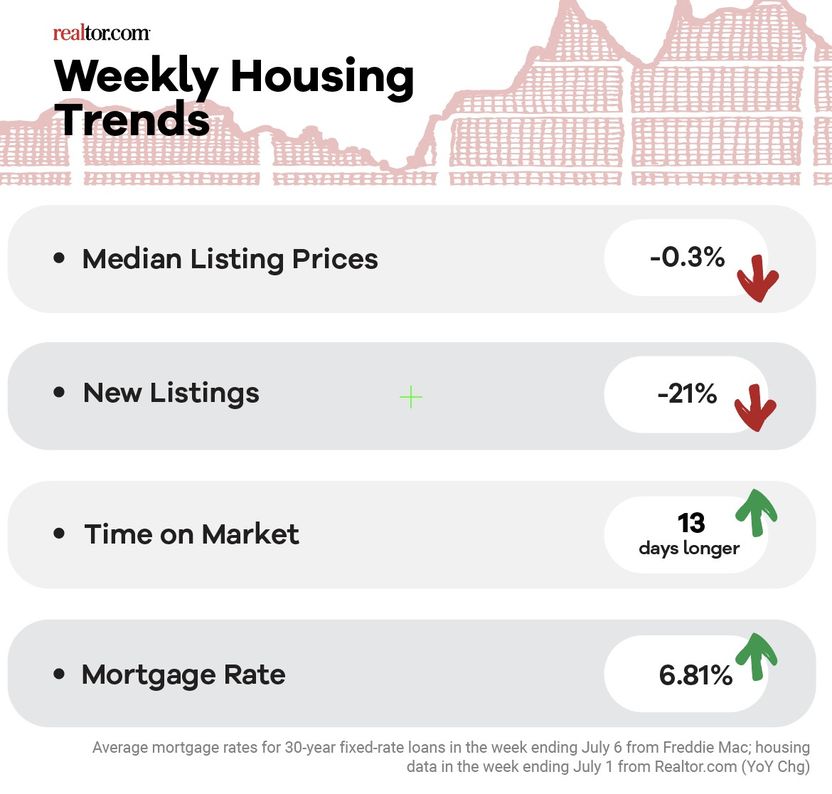

Mortgage rates just jumped to their highest level of the year, averaging 6.81% for a 30-year fixed-rate home loan as of July 6, according to Freddie Mac.

That’s a significant leap from last week’s 6.71%—and more than double the rate that homebuyers enjoyed a mere two years earlier. But times have changed: For the past nine months, rates have hovered above 6%. Plus, although home prices have fallen a bit, they still remain stubbornly above $440,000 throughout 2023.

All in all, it’s enough to make almost any homebuyer wonder: Is buying a home even worth doing today?

For a data-driven answer to that question, here’s what the latest real estate statistics are saying for the week ending July 1 in our column “How’s the Housing Market This Week?”

What high mortgage rates mean for homebuyers and sellers

As if record-high mortgage rates weren’t enough bad news, in another housing gut punch, the number of homes for sale dipped below last year’s level by 2% for the week ending July 1. That’s the first significant drop in inventory in over a year, at 60 weeks.

Sellers’ reluctance to list is directly tied to today’s high rates, with 1 in 7 homeowners choosing not to sell this year because they feel “locked in” to their current lower interest rate loan.

As a result, “the housing market is not getting the influx of homes for sale that it typically does,” notes Danielle Hale, chief economist for Realtor.com®, in her weekly data analysis. “For this reason, our updated 2023 outlook expects inventory to drop this year.”

Realtor.com

Home prices are falling, but not by enough

The glimmer of good news for buyers is that home prices fell by 0.3% for the week ending July 1—the fourth straight week of declines, coming in for June at $445,000.

Still, this barely makes a dent in homebuyers’ higher housing costs, and unless more homes suddenly appear on the market, limited supply will keep prices high.

“The number of homes available for sale remains limited and is likely a factor that is both holding back existing-home sales and keeping prices elevated,” explains Hale.

New listings hit a one-year low

Rubbing salt into weary homebuyers’ wounds is another startling statistic: Not only are mortgage rates up and overall inventory down, but new listings hit a major milestone the week ending July 1, with the number of new homes for sale falling by 21% annually. This marks an entire year—52 weeks—that there were fewer fresh listings than the same time last year.

Meanwhile, the pace of home sales is slowing. For the week ending July 1, homes lingered on the market for 13 more days compared with last year. This marks 50 weeks it’s taken longer to sell a home compared with the same week last year.

In June, homes spent an average of 43 days on the market. Nonetheless, it’s worth noting that this sluggish pace is still faster than before the COVID-19 pandemic.

“June housing data show that the typical home on the market in June spent 10 fewer days on market than in 2017 to 2019,” said Hale.

How homebuyers are finding alternatives

Homebuyers not willing to shell out big bucks for a not-quite-dream home only to face high monthly mortgage payments do have a few alternatives.

One that’s been gaining traction among intrepid homebuyers is new-construction homes, which can often be found at prices lower than for preexisting properties.

“Affordability continues to be stretched,” notes Hale, “and fortunately, builders are continuing to add homes with a somewhat greater focus on affordable price points.”

Other would-be first-time homebuyers might simply choose to keep renting—now that rents have finally started to drop.

“With nationwide rents beginning to decline and homes taking longer to sell, potential first-time homebuyers are likely to feel less urgency,” says Hale. That said, “high costs still make the question of where to live feel high-stakes.”

The post Mortgage Rates Just Hit Their Highest Point This Year: Is It a Blip or a Housing Death Blow? appeared first on Real Estate News & Insights | realtor.com®.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

1637 Racetrack Rd # 100, Johns, FL, 32259, United States