The Income Needed in Each State To Afford a Starter Home at a 7% Mortgage Rate

Getty Images

The new year has ushered in freezing temperatures for much of the nation, but to the chagrin of prospective first-time homebuyers, mortgage rates are only getting hotter.

Mortgage rates are quickly approaching 7% again, after rising each of the first two weeks in January. Nationally, it means the household income now required to afford the typical starter home is $70,164, up more than 100% from just $32,357 in 2019, according to a new analysis from the Realtor.com® economic research team.

Typical incomes have also risen in recent years, though not nearly at the same pace. Median household income was $80,610 in 2023, the latest data year available. That was up 17% from $68,700 in 2019, without adjusting for inflation.

Meanwhile, starter home prices, defined here as the 25th percentile of available list prices, surged over the past five years, to $292,950 in 2024, up from $190,559 in 2019. But rising mortgage rates, which dipped below 4% for much of 2019, have also played a major role in making starter homes less affordable.

Monthly payments on the typical starter home have risen 116% from five years earlier, to $1,754 at 2024 prices and a 7% mortgage rate. To be considered affordable, home payments typically should eat up no more than 30% of household income.

“Though home price growth has contributed significantly to declining affordability, mortgage rate growth has exacerbated the issue,” says Realtor.com senior economic research analyst Hannah Jones. “While starter home prices climbed 53.7% over the last five years, payments more than doubled due to mortgage rates increasing from roughly 4% to almost 7%.

“Falling mortgage rates are crucial to improved housing affordability,” she adds.

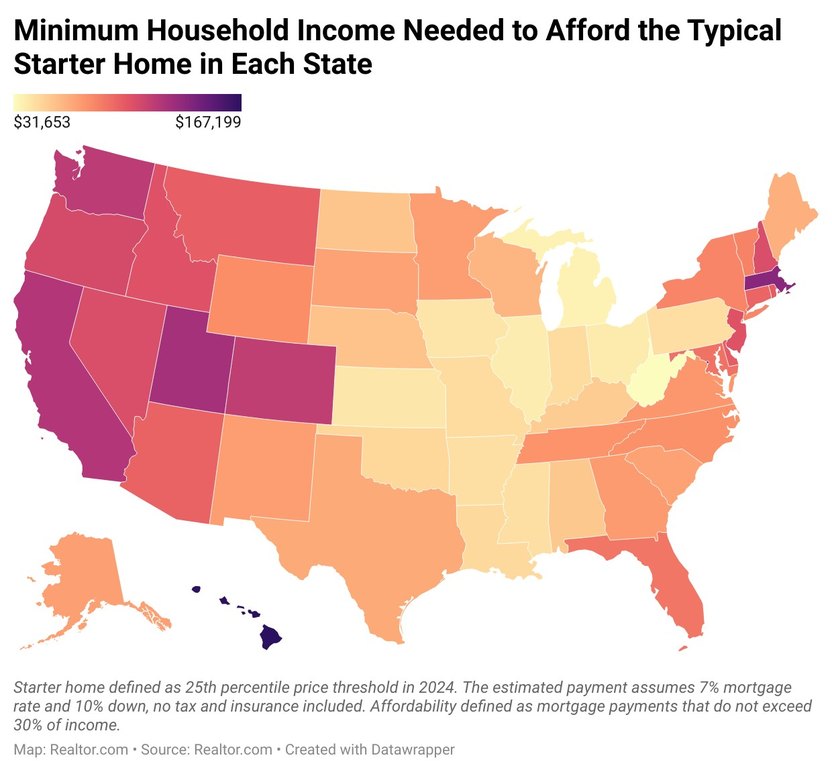

At the state level, affording a starter home in West Virginia requires the lowest household income, at just $31,653. Hawaii, meanwhile, is the toughest state for first-time buyers, requiring an income of $167,199 to afford a home in the bottom quarter of available list prices.

Monthly home payments on starter homes have risen the most in New Hampshire, where they have surged 164% since 2019. The typical monthly mortgage payment for a starter home in New Hampshire is now $2,600, assuming a 10% down payment, which would require an income of $103,985 to be considered affordable.

Monthly payments have risen the slowest in Louisiana, but even there they are up 77% from five years earlier. Starter homes in the Bayou State now require an income of $46,752 to be considered affordable, up from $26,468 in 2019.

Affordability challenges have pushed many first-time buyers to the sidelines. Last year, the share of all successful homebuyers who were first-timers dropped to 24%, the lowest on record.

First-timers, who are often earlier in their careers with lower income and less savings, face the additional hurdle of entering the market without any prior home equity to lean on.

The new analysis defined a starter home as a home priced at the 25th percentile price for an area across 2024. The estimated payment for 2024 assumes a 7% mortgage rate and a 10% down payment (tax and insurance are excluded).

The estimated payment for 2019 assumes a 3.9% mortgage rate and 10% down. The minimum required income assumes that mortgage payments do not exceed 30% of income.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

1637 Racetrack Rd # 100, Johns, FL, 32259, United States