Mortgage Rates Rise to 6.79% in the Wake of Trump’s Presidential Victory

Realtor.com; Getty Images (1)

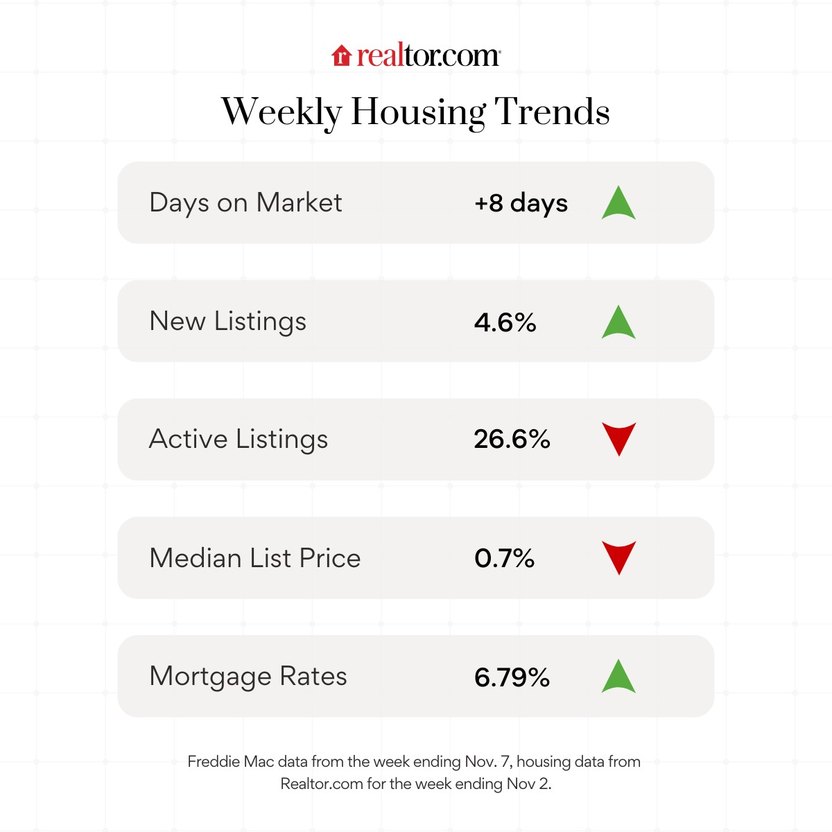

Mortgage rates rose from 6.72% last week to 6.79% for a 30-year fixed home loan for the week ending Nov. 7, according to Freddie Mac.

“Mortgage rates continued to inch up this week, reaching 6.79%,” Sam Khater, Freddie Mac’s chief economist, said in a statement.

This shift comes after the presidential election, which has “the potential to influence mortgage rates in both the short and long term,” says Realtor.com® senior economic research analyst Hannah Jones in her report.

Indeed, the day after the election, the 10-year Treasury yield jumped to nearly 4.7—”rising to the highest levels since April in the wake of a Trump-Vance victory and Republican election sweep,” says Realtor.com senior economist Ralph McLaughlin.

(Mortgage rates generally move in tandem with the 10-year Treasury yield, with lenders setting their daily rates based on the underlying bond markets.)

Why are the 10-year yields, and mortgage rates, rising so quickly after the Trump triumph?

“While it’s not always 100% clear what markets are thinking, they could be expecting a combination of stronger economic growth, more fiscal spending, as well as higher prices and inflation because of more tariffs and lower taxes,” explains McLaughlin.

As the election results continue to sink in and markets keep responding, here’s a snapshot of the latest housing market data and what it means for homebuyers and sellers in the latest installment of our “Weekly Housing Market Update.”

Mortgage rates may remain volatile

It’s not only a roller-coaster election cycle that’s turning the economy upside down—U.S. employers added just 12,000 jobs in October. That’s one-tenth of the average monthly gain of 194,000 jobs over the past 12 months.

This sharp decline was partly due to last month’s labor strikes and Hurricanes Helene and Milton.

But instead of taking the latest jobs report as a sign of the employment market easing, “the market took the report as an outlier, and the reaction delivered no mortgage rate relief,” says Jones.

The overall economic volatility marks the sixth week in which mortgage rates have risen—and high rates are bad news for anyone looking to buy or sell in the housing market this fall.

“While we still expect mortgage rates to stabilize by the end of the year, they will likely be at a higher level than markets were initially expecting prior to election week,” says McLaughlin.

As a result, some buyers and sellers may hold off entering the market until the new year.

Home prices dip slightly

In a slight counter to rising rates, the median list price for homes dropped by 0.7% for the week ending Nov. 2 compared with the same period last year.

This marks the 23rd week in a row that the median list price was less than or equal to what it was in the same week in 2023. (The median-priced home was $424,950 in October.)

However, when a change in the mix of inventory toward smaller homes is accounted for, the median listing price per square foot increased by 1.8% the week ending Nov. 2 compared with the same time last year.

The number of homes for sale surges

Buyers had abundant housing options the week ending Nov. 2—with 4.6% more fresh listings hitting the market than last year.

Overall housing stock was also up 26.6% above year-ago levels, and this uptick marks 52 weeks in which the number of listings was above the same week a year ago.

“Inventory has climbed annually for a full calendar year due in part to slowing buyer activity,” says Jones.

Homebuyers are taking their time

Buyers have been dragging their feet on making offers due to volatile mortgage rates.

For the week ending Nov. 2, homes spent eight more days on the market than the same time last year. (In October, homes spent a median of 58 days on the market.)

While that’s not great for sellers, it’s a big plus for buyers.

McLaughlin says homebuyers should be optimistic about buyer-friendly characteristics in the housing market such as “the slowest seasonal market in five years, nearly 20% of listings coming with price cuts, and the highest inventory since December 2019.”

With more options available, “still-keen buyers may be feeling ready to act before winter,” says Jones.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

1637 Racetrack Rd # 100, Johns, FL, 32259, United States