Mortgage Rates Surge to a 22-Year High, but We See a ‘Glimmer of Optimism’ Ahead

Getty Images

Homebuyers who flinched at last week’s mortgage rates hitting a 20-year high might want to brace themselves: This week, rates topped that, reaching a 22-year high.

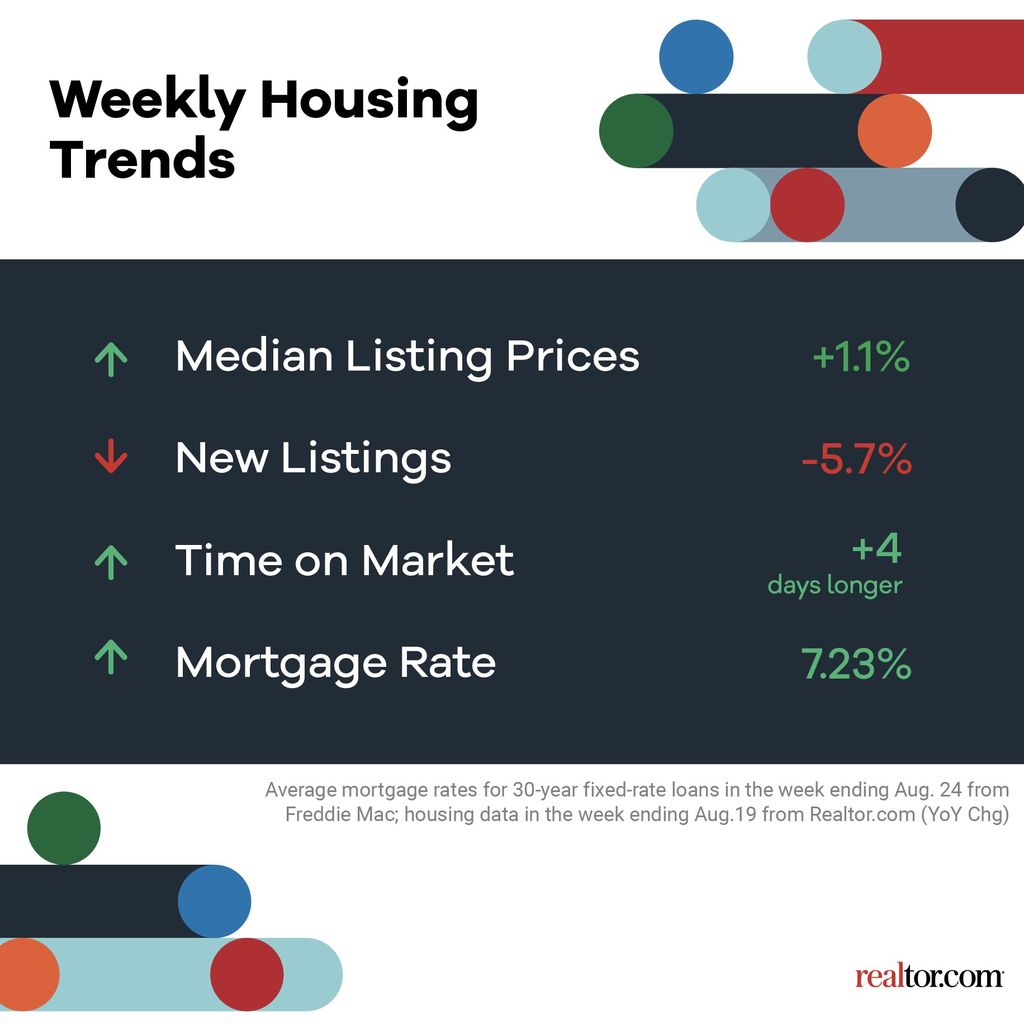

For the week ending Aug. 24, rates for a 30-year fixed-rate home loan averaged 7.23%—a worrying increase from last week’s 7.09%, according to Freddie Mac.

In addition to dealing with skyrocketing rates, homebuyers are grappling with rising home prices and fewer listings. In short, nothing in this trio “tilts in favor of buyers in today’s market,” Realtor.com® economist Jiayi Xu says in her analysis.

So, as August marches to a close and both buyers and sellers size up their summers, the question is whether there will be any relief come fall.

According to Xu, a “glimmer of optimism” looms in the real estate market as the sun sets on the summer of ’23.

We’ll explain what all the highs and lows of the latest real estate statistics mean for buyers and sellers in our latest installment of “How’s the Housing Market This Week?”

Will mortgage rates keep rising in 2023?

Where rates will land as the year comes to an end is anyone’s guess. However, according to Xu, there is reason to hope for a somewhat friendlier mortgage rate in the coming months.

Some experts anticipate that the Federal Reserve—which has raised interest rates 11 times to tame inflation—might adopt a wait-and-see strategy at its next meeting in September.

And that “may help potentially mitigate the recent upward trajectory of mortgage rates,” explains Xu.

Median list prices just won’t cool down

In July, home prices came in at a median of $440,000. And as a further stress on homebuyers, prices rose 1.1% for the week ending Aug. 19 compared with the previous year—the fourth week in a row of climbing prices.

Yet Xu notes, overall “a discernible downward trend emerged late in August.”

Another silver lining is that list prices are unlikely to hit last June’s record-high median of $449,000.

House keys are staying in sellers’ pockets

These record-high rates aren’t just a kick in the gut for buyers. They’re also a hurdle for sellers looking to move who instead remain handcuffed to their existing low mortgage rates—and houses.

As a result, new listings were down by 5.7% year over year for the week ending Aug. 19—the 59th week in a row these numbers dwindled. Overall inventory (a measure of new and old listings) also declined for the week ending Aug. 19, falling 7.2% compared with last year.

But buyers (and sellers) take note: “This gap has been shrinking,” says Xu. “This week’s data shows a 2.4 percentage point improvement over last week.”

And within this data lies a potential break in the housing clouds: “If the current trend of a narrowing gap in inventory persists, it will be very likely to see more newly listed homes available than the record low set last fall and winter,” says Xu.

The autumn market might heat up

Buyers struggling with high mortgage rates and home prices can at least take comfort in knowing that they don’t have to rush to the closing table these days.

For the week ending Aug. 19, homes spent four extra days on the market compared with this time last year. This marks 57 weeks in a row that the time a typical home has been on the market is up year over year.

Yet the gap between how many days a home spent on the market in 2022 compared with 2023 is shrinking.

“By fall, we could even see homes selling faster than one year ago,” adds Xu.

The post Mortgage Rates Surge to a 22-Year High, but We See a ‘Glimmer of Optimism’ Ahead appeared first on Real Estate News & Insights | realtor.com®.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

1637 Racetrack Rd # 100, Johns, FL, 32259, United States