Top 10 States With the Lowest Mortgage Payments—Including One Where They’re Below $2K a Month

TriggerPhoto/iStock

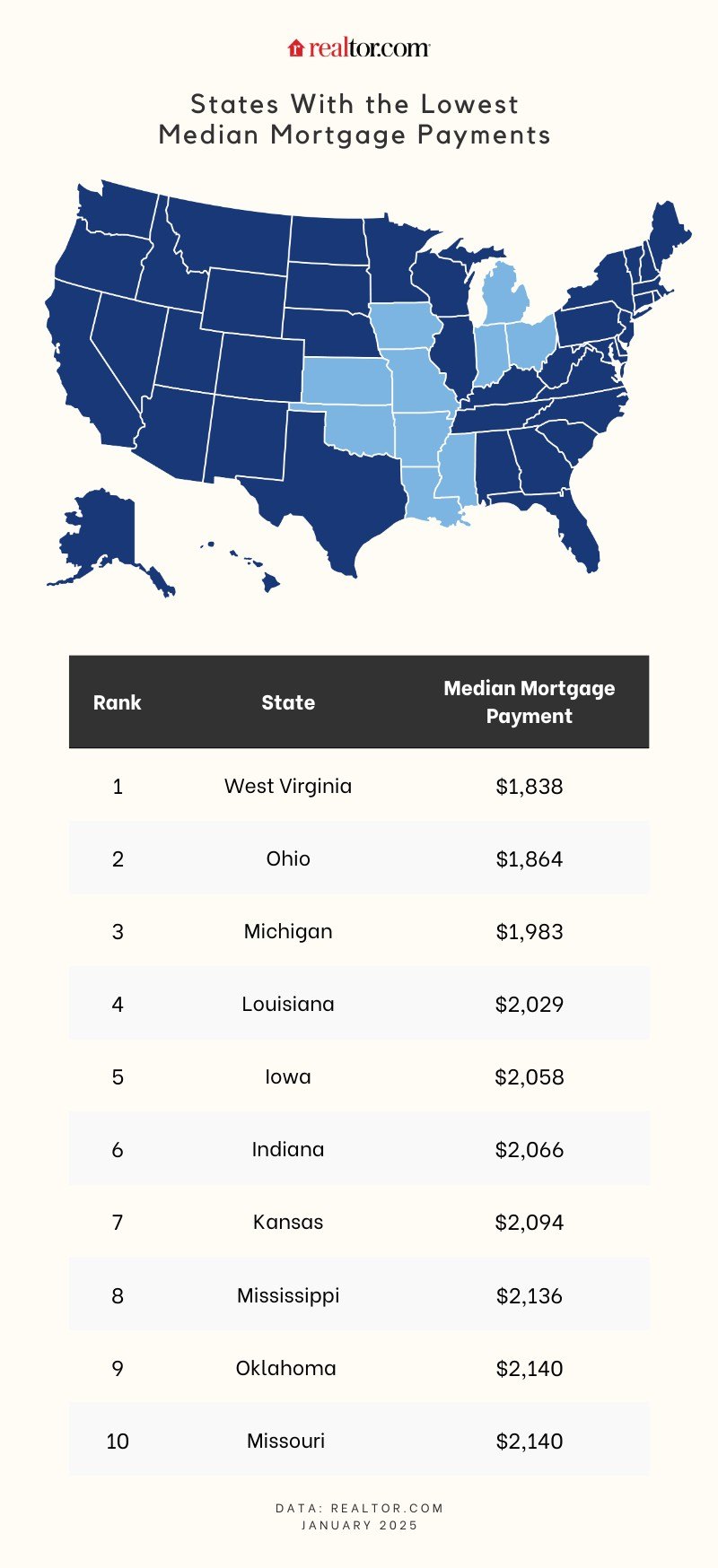

Mortgage rates continue to hover stubbornly around 7%, but how much money homeowners pay each month can vary dramatically from state to state, with West Virginia earning the distinction of having the lowest mortgage payments in the U.S.

The median payment for a homeowner in the Mountain State was $1,838, according to the latest available data from Realtor.com®, based on a 30-year fixed mortgage rate of 6.96%.

“In today’s high-rate environment, housing payments are fairly high across the country. However, areas with lower-priced homes see lower monthly mortgage payments,” says Realtor.com senior economic research analyst Hannah Jones. “The median home price was just $249,000 in West Virginia in December, the lowest of any state in the country, and the typical housing payment reflects that.”

Ohio was the second-cheapest state for mortgage payments, with the median monthly amount standing at $1,864, followed by Michigan at $1,983.

“Ohio was the second-least-expensive state in the U.S. in December with a median home price of $252,500, which is reflected in a relatively low estimated housing payment,” according to Jones.

It is noteworthy that the 10 states where homeowners shell out the least amount of money for mortgages are all located in the South and Midwest regions, where home prices tend to skew lower than anywhere else in the nation.

In Louisiana, Iowa, Indiana, and Kansas, the median monthly payments ranged between $2,000 and just under $2,100.

Oklahoma and Missouri shared the No. 9 spot on the list, with the monthly payment at $2,140, and Arkansas closed out the top 10 with a median mortgage bill of $2,148 per month at the current rate.

Nationally, the median mortgage payment amounted to $2,971.

For comparison, Hawaii had the highest estimated mortgage payment of $5,904 last month, followed by Massachusetts with $5,406 and California with $5,277. These high figures reflect the median home prices in these states being well above the national median of $402,500.

“Though the country’s most affordable states offer buyers relatively inexpensive homeownership, housing demand for low-priced homes means that home prices are growing,” says Jones. “Climbing prices in affordable areas mean that even with improving mortgage rates, housing payments could continue to get more expensive shortly.

(Realtor.com)

10 states with the lowest monthly mortgage payments

1. West Virginia

Mortgage payment: $1,838

Median list price: $249,000

( DenisTangneyJr/Getty Images)

2. Ohio

Mortgage payment: $1,864

Median list price: $252,500

3. Michigan

Mortgage payment: $1,983

Median list price: $268,700

4. Louisiana

Mortgage payment: $2,029

Median list price: $274,950

(Realtor.com)

5. Iowa

Mortgage payment: $2,058

Median list price: $278,850

6. Indiana

Mortgage payment: $2,066

Median list price: $279,900

7. Kansas

Mortgage payment: $2,094

Median list price: $283,712

(Getty Images)

8. Mississippi

Mortgage payment: $2,136

Median list price: $289,450

9. Missouri

Mortgage payment: $2,140

Median list price: $289,900

9. Oklahoma

Mortgage payment: $2,140

Median list price: $290,000

10. Arkansas

Mortgage payment: $2,148

Median list price: $291,000

(Getty Images)

5 states with the highest monthly mortgage payments

1. Hawaii

Mortgage payment: $5,904

Median list price: $800,000

Mortgage payment: $5,406

Median list price: $732,450

3. California

Mortgage payment: $5,277

Median list price: $715,000

4. New York

Mortgage payment: $4,742

Median list price: $642,500

5. Montana

Mortgage payment: $4,461

Median list price: $604,500

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

1637 Racetrack Rd # 100, Johns, FL, 32259, United States